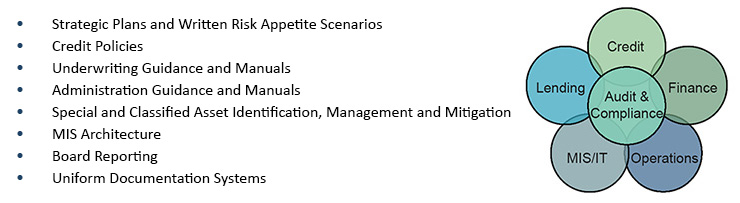

PD&J can, through targeted assessment and consulting, assist family offices, private and institutional funds, and banks (both domestic and foreign) in identifying strengths and addressing weakness in their GRC programs and processes. PD&J can help tailor and lay a new foundation and build an appropriate “best practices” framework within which to identify, monitor, control and mitigate risk matched with any particular lender or investor’s appetite for risk. Up-front, we focus on developing sound credit principles and due diligence policies and procedures to evaluate risk. Subsequent to closing, the focus switches to leading indicators as opposed to management by delinquency. A holistic overlapping concentric circle approach between the Investment or Lending, Credit, Finance, Compliance, Audit, Operations and Administrative disciplines is utilized to ensure that an acceptable degree of continuity, integrity, compliance and communication is established at all levels of underwriting, management and reporting. PD&J is credentialed in assessing, developing, revising or replacing the following:

Our angle of approach is to develop a streamlined, regulatory compliant and uniform system upon which Senior Management, Boards and Investors can rely. Whether you are a small family office making individual private equity investments or a commercial bank, we can help you manage credit risk from cradle to grave.